"Four out of five founders are eventually forced out by their boards."

Noam Wasserman, “The Founder’s Dilemma,” Harvard Business Review , February 2008

The recent whirlwind at OpenAI with Sam Altman is a vivid testament to this statistic. Altman's abrupt exit and return to OpenAI have highlighted the precarious balance between a founder's vision and the pragmatic role of the board.

With its dramatic turns and governance missteps, The Open AI saga provides a crucial lesson for corporate boards globally. It highlights the importance of understanding not only their role but also the intricacies of the business and the pulse of its employees.

How can founders build strong boards that align with their vision while effectively guiding the company towards sustainable growth? As we explore past and present boardroom dramas, we'll unravel the complexities of this dynamic and its profound implications for the future of innovative companies.

A History of Boardroom Battles

Open AI’s boardroom turmoil isn't an isolated case but part of a larger story unfolding in the tech world, where visionary founders frequently encounter significant governance hurdles with their boards.

Such scenarios unfold across various sectors in the tech industry, each marked by its own unique challenges and complex dynamics.

From boardroom tensions at Apple to the leadership dilemmas at Uber, the following stories are about the tug of war between innovation and control, between pushing boundaries and playing it safe. They can also illuminate the challenges and triumphs of steering pioneering tech companies through times of transformation.

Steve Jobs at Apple

In the late '80s, Apple faced a defining moment that reshaped its future and the tech industry at large. Steve Jobs, found himself at odds with CEO John Sculley and the board over the company's direction. Jobs, a champion of groundbreaking innovation, was pitted against a board favoring a market-oriented, conservative approach. The conflict culminated in Jobs being ousted, leading him to start NeXT. In a dramatic twist, Apple later acquired NeXT, bringing Jobs back to lead the creation of Apple’s transformative products.

Travis Kalanick at Uber

Travis Kalanick's ride at Uber was a rollercoaster ride. He turned the startup into a global powerhouse, but as Uber sped ahead, it hit bumps over its internal culture and Kalanick's hard-charging leadership style. The final straw came when a series of internal inquiries exposed deep-rooted issues, including sexual harassment and gender discrimination. Faced with mounting pressure and investor unease, the board saw no other option but to part ways with Kalanick in 2017.

Jack Dorsey at Twitter

Jack Dorsey's journey at Twitter is a tale of visionary leadership, relentless challenges, and unexpected turns. Initially ousted in 2008 due to his perceived inexperience in running the company, Dorsey made a dramatic return in 2015. His second stint, however, unfolded under the watchful eyes of activist investors like Elliott Management, advocating for change amidst Twitter's stagnating performance. Dorsey's eventual resignation in 2021, concluding his 16-year tenure, was a mix of strategic retreat and inevitability as he pivoted his focus to passions like Bitcoin and cryptocurrencies.

Jerry Yang at Yahoo

Yahoo's tale is a bit different. Co-founder Jerry Yang stepped up as CEO during turbulent times, notably resisting Microsoft's acquisition bid in 2008. This move led to a rift with shareholders and the board, who saw the refusal as a missed opportunity. Yang's subsequent stepping down marked a pivotal moment for Yahoo, leading to years of struggle and its eventual sale to Verizon.

Elizabeth Holmes at Theranos

Elizabeth Holmes' journey with Theranos is a story of ambition, controversy, and a dramatic fall from grace. As the young founder and CEO, Holmes promised to revolutionize blood testing with technology that later proved to be fundamentally flawed. Demonstrating her ability to draw influential leaders into her vision, she assembled a board comprising prominent figures like Henry Kissinger, James Mattis, and George Shultz.

Her strong control over Theranos and its board initially shielded her vision from scrutiny. However, as investigations unfolded, it became clear that the company's claims were vastly overstated. The ensuing scandal not only led to Holmes' downfall but also raised serious questions about board oversight, investor due diligence, and the ethical responsibilities of tech startups.

Carly Fiorina at Hewlett-Packard

Carly Fiorina's time at HP was marked by bold decisions and high drama. Her most controversial move was the acquisition of Compaq, a decision that divided the board and shareholders. Fiorina argued it was a necessary step for HP's growth, but critics saw it as a risky and misguided strategy that diverged sharply from HP's core values. The tension escalated, leading to a public fallout, and in 2005, Fiorina was forced to step down.

Martin Eberhard at Tesla

Tesla’s journey in the early 2000s had its share of drama, with Martin Eberhard at the center. As co-founder, Eberhard was steering the company toward revolutionizing electric cars. But internal tides shifted swiftly. First stepping down as CEO, Eberhard saw his role within Tesla change again and again in a short span, ultimately leading to his advisory position and then his exit. The backdrop? Disagreements over Tesla's direction, specifically the persistent transmission issues delaying their first vehicle. Eberhard's disappointment was palpable, as he grappled with the politics of leadership change and the divergent views on solving Tesla’s problems.

The Balancing Act: Innovation vs. Governance

How can boards support groundbreaking innovation while maintaining effective oversight? For the visionaries, how can they align their bold ideas with the necessary governance structures? Perhaps the answer lies in finding a common language, a shared vision that harmonizes the drive for innovation with the principles of responsible governance.

Altman's push to rapidly advance generative AI and explore commercial opportunities collided with the board's concerns about pacing and ethical implications resulting in a seismic boardroom shake-up that reverberated through the techworld.

The situation at OpenAI has brought into sharp focus the European Union's AI Act, aiming to establish a comprehensive regulatory framework for artificial intelligence. Alexandra van Huffelen, the Dutch Minister for Digitalisation, stressed the importance of regulation:

The lack of transparency and the dependence on a few influential companies, in my opinion, clearly underlines the necessity of regulation.

Similarly, European Parliament lawmaker Brando Benifei highlighted the need for enforceable regulations:

We cannot rely on voluntary agreements brokered by visionary leaders. Regulation needs to be sound, transparent, and enforceable to protect our society.

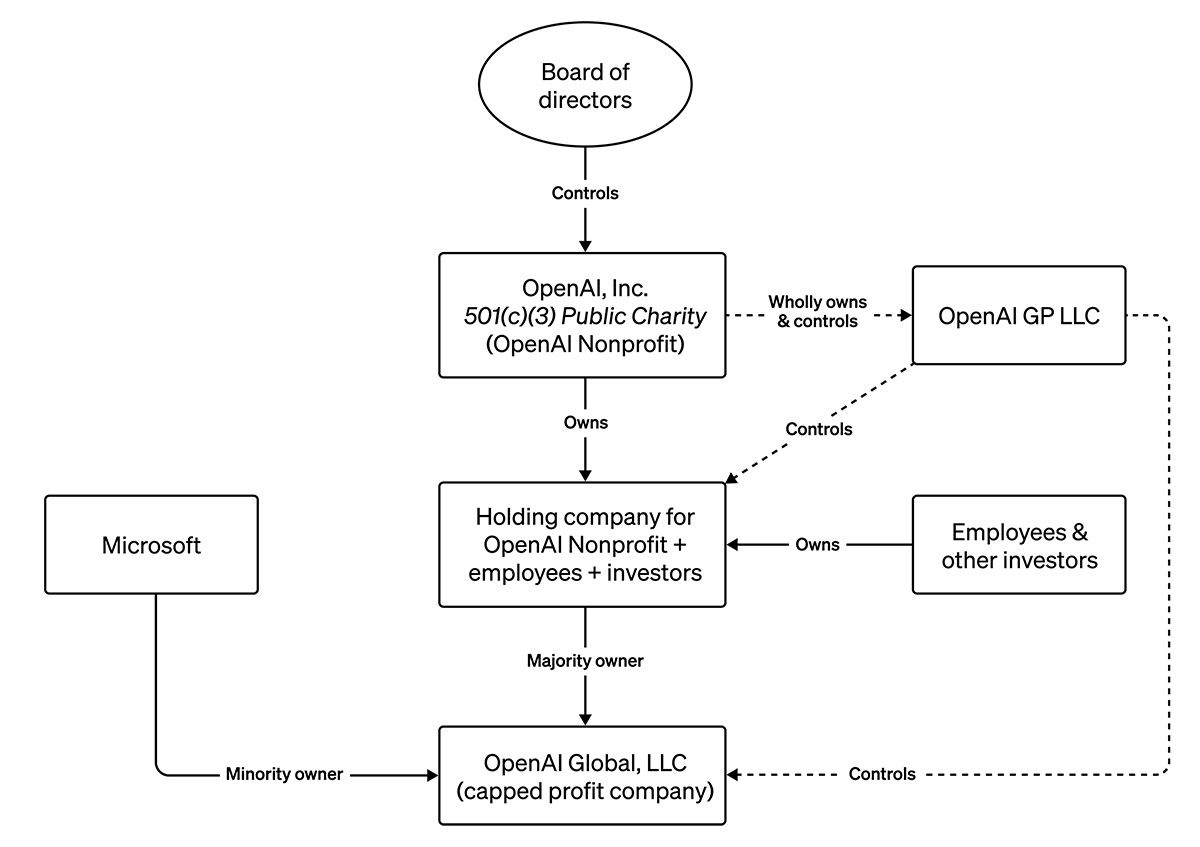

OpenAI's structure, a non-profit entity controlling a for-profit subsidiary, starkly contrasts with other Silicon Valley giants where founders often create structures to maintain long-term control. In this unique setup, Altman, despite his visionary status, wasn't safeguarded against board decisions, unlike founders in companies like Google, who secured their influence through intricate share classes.

Image source:Bloomberg 'Who Controls OpenAI'

Image source:Bloomberg 'Who Controls OpenAI'

The backlash from OpenAI's employees against Altman's dismissal underscores a deep faith in his vision. The board's lack of insight into employee sentiments became immediately apparent highlighting a significant gap of understanding within the organization. This emphasizes the importance of boards not only being in tune with the company's strategic direction but also deeply understanding the pulse of the organization's culture and employee sentiments.

However, this incident could also be interpreted as a move towards enhanced corporate accountability – something critics argue is sorely needed in the rapidly evolving, high-stakes world of tech. Given the profound impact that tech companies can have on society, the need for balanced, transparent governance is increasingly apparent.

Dr. Joanne Gray, a media and communications lecturer, observes,

"Silicon Valley urgently needs more accountability, because too many tech entrepreneurs work at an intersection of risk, hype and boundary-pushing"*

Figures like regulator Lina Khan are pushing for greater accountability in big tech, suggesting a shift from blind faith in visionary leaders to a model that emphasizes public oversight and responsible stewardship.

Conclusion

How can boards in tech companies, especially those like OpenAI at the forefront of AI, strike the right balance between nurturing visionary ideas and ensuring responsible, ethical progress?

How can boards in tech companies, especially those like OpenAI at the forefront of AI, strike the right balance between nurturing visionary ideas and ensuring responsible, ethical progress?

In the tech industry, where the pace of innovation is relentless, and the stakes are high, the composition and expertise of the board become even more critical. A strong board brings diverse perspectives, experience in scaling companies, and an understanding of the delicate balance between risk-taking and prudent decision-making. It can act as a compass, guiding the company through uncharted waters of rapid growth and market disruption while ensuring that the founder's vision isn't lost in the process.

As we've seen through various examples, the relationship between a founder and the board can make or break a company. The founders who navigate this relationship successfully are the ones who understand the importance of building a board that shares their vision yet can provide the necessary oversight and guidance. This shared vision is essential for harmonizing the pursuit of innovation with responsible governance principles.

Introducing Boardshape

Our board management software is a valuable tool when streamlining your meetings. Our agenda builder enables you to;

- Collaboratively create an agenda

- Assign agenda items to participants

- Collect all the meeting materials in a centralized location.

- Include live polls for decision making.

- Easily track follow up communication through comment sections for each item.

- Our presentation mode keeps everyone in sync during the meeting with the right documents at everyones’ finger tips at the right time.